Keyword silo: KYC request

Word count: 1000+

HTML tags:

A KYC request is a request from a financial institution or other regulated entity for a customer to provide certain information to verify their identity and assess their risk profile. KYC stands for "Know Your Customer," and it is a global standard for preventing financial crime, such as money laundering and terrorist financing.

Why do financial institutions need to know their customers?

Financial institutions need to know their customers in order to:

- Comply with anti-money laundering (AML) and counter-terrorism financing (CFT) regulations. These regulations require financial institutions to identify and report suspicious activity to the authorities.

- Assess the risk of doing business with a customer. Financial institutions need to know their customers' financial situation, risk appetite, and investment objectives in order to offer them appropriate products and services.

- Prevent fraud. Financial institutions need to be able to verify the identity of their customers in order to prevent fraudulent transactions.

What information is typically required for a KYC request?

The specific information required for a KYC request will vary depending on the financial institution and the customer's relationship with the institution. However, some common information that may be requested includes:

- Full name

- Date of birth

- Address

- Contact information

- Government-issued identification

- Proof of income and/or employment

- Investment objectives

How do I complete a KYC request?

To complete a KYC request, you will typically need to provide the requested information to the financial institution in person, online, or by mail. If you are providing the information in person, you will need to bring your government-issued identification with you. If you are providing the information online or by mail, you will typically need to upload copies of your identification and other required documents.

How long does it take to complete a KYC request?

The time it takes to complete a KYC request will vary depending on the financial institution and the complexity of the request. However, most KYC requests can be completed within a few days or weeks.

What are the benefits of completing a KYC request?

There are several benefits to completing a KYC request, including:

- Access to a wider range of financial products and services. Many financial institutions will not offer certain products and services to customers who have not completed a KYC request.

- Faster and easier account opening and transaction processing. Financial institutions that have already verified your identity will be able to open accounts and process transactions for you more quickly and easily.

- Reduced risk of fraud. KYC helps to protect financial institutions from fraud by verifying the identity of their customers.

What are the risks of not completing a KYC request?

There are several risks associated with not completing a KYC request, including:

- Being denied access to financial products and services. Many financial institutions will not offer certain products and services to customers who have not completed a KYC request.

- Having your account frozen or closed. Financial institutions may freeze or close accounts if they are unable to verify the identity of their customers.

- Being reported to the authorities. Financial institutions are required to report suspicious activity to the authorities, and this may include activity from customers who have not completed a KYC request.

How can I protect my privacy when completing a KYC request?

There are several things you can do to protect your privacy when completing a KYC request, including:

- Only provide information that is required. You do not have to provide any additional information that is not specifically requested by the financial institution.

- Be careful about who you share your personal information with. Only provide your personal information to financial institutions that are reputable and have a good track record of protecting customer privacy.

- Review the financial institution's privacy policy before providing your information. The privacy policy will explain how the financial institution will use and protect your personal information.

Conclusion

KYC requests are an important part of the financial system. By completing KYC requests, you can help to prevent financial crime and protect yourself from fraud.

WebIn this post, we'll show you how to request and verify KYC documents in a quick, easy, and compliant way to protect your business from criminal activity or even avoid hefty. WebThe Know Your Client (KYC) or Know Your Customer (KYC) is a process to verify the identity and other credentials of a financial services user. KYC is a regulatory process of. WebKYC is the short form for Know Your Customer and it is carried out by companies to verify the identity of customers in compliance with laws, regulations, and. WebSometimes called the KYC check, KYC verification is the process of identifying and verifying a potential customer's identity during onboarding. KYC is a set of. WebDiscover the importance of KYC with Nexis Solutions UK as your trusted partner. What is Know Your Customer (KYC)? Know Your Customer (KYC) refers to the policies and.

AML & KYC Interview Questions & Answers! (Know Your Customer and Anti-Money Laundering Interviews!)

Source: Youtube.com

AML/KYC Analyst roles, what exactly do they do

Source: Youtube.com

What Is A Kyc Request, AML & KYC Interview Questions & Answers! (Know Your Customer and Anti-Money Laundering Interviews!), 19.64 MB, 14:18, 150,951, CareerVidz, 2022-06-22T14:45:30.000000Z, 2, KYC Guide 2023—What's KYC and Why is It Important? | The Sumsuber, 710 x 1000, jpg, , 3, what-is-a-kyc-request

What Is A Kyc Request.

AML & KYC Interview Questions & Answers! (Know Your Customer and Anti-Money Laundering Interviews!) passmyinterview.com/aml-kyc-interview/

#interviewquestionsandanswers #kyc #knowyourcustomer

**************************************************************

DOWNLOAD 21 SUPERB ANSWERS TO THE TOUGHEST AML AND KYC INTERVIEW QUESTIONS:

passmyinterview.com/aml-kyc-interview/

**************************************************************

In this tutorial, Richard McMunn will teach you how to prepare for an AML and KYC job interview. if you are applying for any anti-money laundering and know your customer job role, stay tuned because the tips and sample questions will help you to be the standout candidate!

21 AML & KYC INTERVIEW QUESTIONS AND ANSWERS

Q1. Tell me about yourself. 01:29

Q2. What do you know about KYC? 03:46

Q3. What's the difference between AML and KYC? 05:58

Q4. What are the different stages of money laundering? 06:54

Q5. What steps would you follow when conducting customer due diligence? 08:52

Q6. Why do you want to work in this AML / KYC position?

Q7. What is the difference between source of wealth and source of funds?

Q8. What are your strengths? 10:59

Q9. What's your biggest weaknesses? 12:02

Q10. What are the most important skill and qualities needed to work in AML and KYC?

Q11. Tell me about at time when you had a positive impact in a team or organization.

Q12. How would you deal with a conflict with a co-worker?

Q13. What motivates you?

Q14. What steps do you take to ensure your knowledge of the financial industry is up-to-date?

Q15. Do you think working late is a good or bad thing?

Q17. Why do you want to leave your current job?

Q18. Where do you see yourself in 5 years' time?

Q19. What are your salary expectations?

Q20. Why should we hire you in this AML / KYC position?

Q21. That's the end of your AML and KYC interview. Do you have any questions?

MORE GREAT TUTORIALS TO HELP YOU PREPARE FOR AN AML & KYC INTERVIEW!

Finance interview questions and answers: youtu.be/lQSVdohbQbc

Financial analyst job interview questions: youtu.be/VESSexbXHbA

Finance Manager interview questions: youtu.be/dGRP1YH_tHc

PWC interview questions: youtu.be/mxhpjBT_ymo

Deloitte interview questions: youtu.be/vwxHAfu9VlY

EY interview questions and answers: youtu.be/m5VVqm43j7Y

CONNECT WITH RICHARD MCMUNN ON LINKEDIN.COM:

linkedin.com/in/richard-mcmunn-coach/

**************************************************************

DOWNLOAD 21 SUPERB ANSWERS TO THE TOUGHEST AML AND KYC INTERVIEW QUESTIONS:

passmyinterview.com/aml-kyc-interview/

**************************************************************

What Is A Kyc Request, WebSometimes called the KYC check, KYC verification is the process of identifying and verifying a potential customer's identity during onboarding. KYC is a set of. WebDiscover the importance of KYC with Nexis Solutions UK as your trusted partner. What is Know Your Customer (KYC)? Know Your Customer (KYC) refers to the policies and.

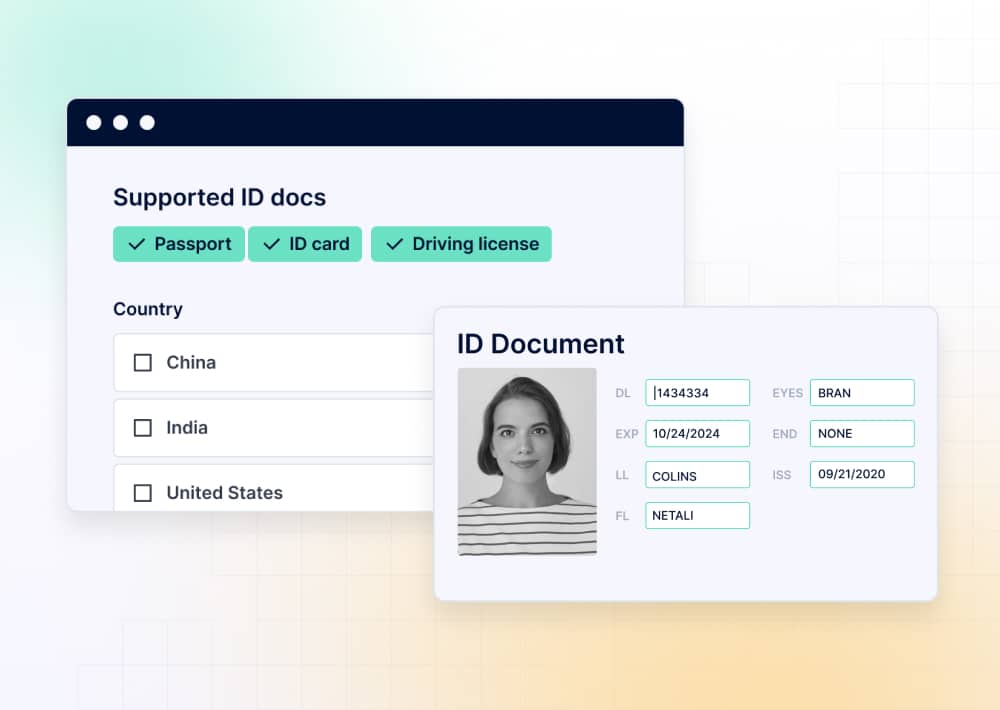

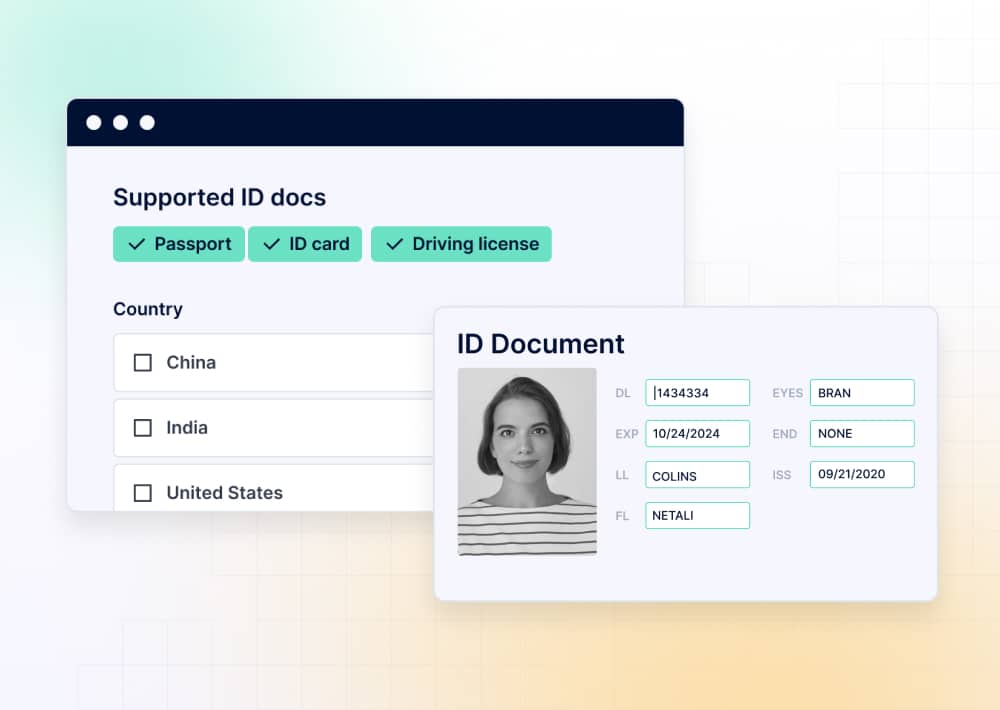

KYC Guide 2023—What's KYC and Why is It Important? | The Sumsuber - Source: sumsub.com

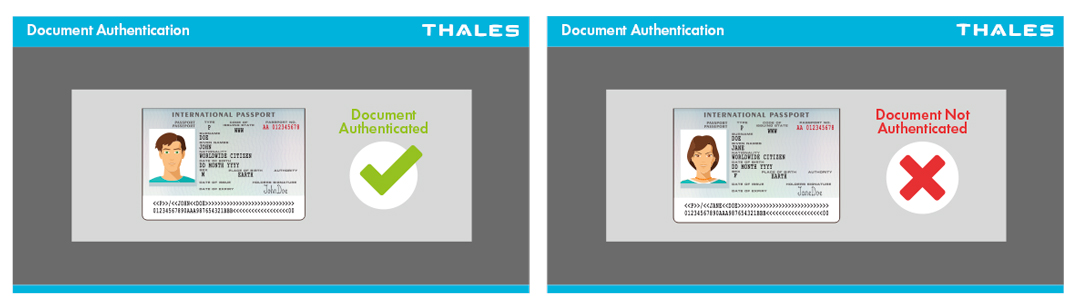

What is KYC in Banking? (Updated) - Source: thalesgroup.com

What is KYC in Banking? (Updated) - Source: thalesgroup.com

What is kyc and its purpose

What is kyc and its purpose What is kyc approval.

What is kyc approval www.investopedia.com › terms › kKnow Your Client (KYC): What It Means, Compliance Requirements

What is kyc approval KYC: The Know Your Client form is a standard form in the investment industry that ensures investment advisors know detailed information about their clients' risk tolerance , What is kyc required.

What is kyc required

What is kyc required What is a kyc questionnaire.

.

What is a kyc questionnaire

What is a kyc questionnaire What is a kyc request.

.

What is a kyc request

What is a kyc request What is a kyc questionnaire.

www.okta.com › identity-101 › kyc-verificationThe KYC Verification Process: 3 Steps to Compliance | Okta

KYC verification is a component of KYC (Know Your Customer) that can help organizations to ensure that a customer is who they say they are. KYC verification uses a customer identification procedure (CIP) to verify the identity of a user during the onboarding process. KYC verification can also be used to help monitor accounts and transactions , .

.

.

appian.com › learn › topicsKYC Process: The Complete Guide | Appian

The KYC process begins with a customer's first interaction during onboarding. First impressions matter, and an inefficient customer onboarding could put customers and revenue at risk. On the other hand, friction-free onboarding can result in top customer experience scores which can give banks the advantage of a 15% revenue increase, are , .

.

.

.

.

www.financestrategists.com › banking › know-yourKnow Your Customer (KYC) | Definition, Components, & Process

Know Your Customer (KYC) is the process financial institutions follow to verify their customers' identities, assess risk profiles, and monitor transactions. KYC is crucial for preventing financial crime, such as money laundering and terrorist financing, and ensuring compliance with anti-money laundering (AML) and counter-terrorism financing , .

www.kychub.com › blog › kyc-know-your-customerWhat is KYC (Know Your Customer)? - A Complete Guide - KYC Hub

Know Your Customer is a critical process for financial institutions and businesses, enabling them to verify the identity of their customers and assess the risks associated with them. With the growing risk of financial crimes and regulatory requirements, implementing a robust KYC system is essential for businesses to protect themselves and their , .

plaid.com › resources › bankingWhat is KYC? Financial regulations to reduce fraud | Plaid

KYC is a legal requirement for financial institutions and financial services companies to establish a customer's identity and identify risk factors. KYC procedures help prevent identity theft, money laundering, financial fraud, terrorism financing, and other financial crimes. Failure to meet KYC requirements can result in steep fines and , .

www.swift.com › know-your-customer-kyc › kyc-processThe KYC process explained | Swift

KYC, or " Know Your Customer ", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and individuals they do business with, and ensures those entities are acting legally. Effective KYC protects companies from doing business with organisations or individuals involved in illegal , What is kyc and its purpose.

Post a Comment